Last Updated on May 15, 2018 by FUNAAB

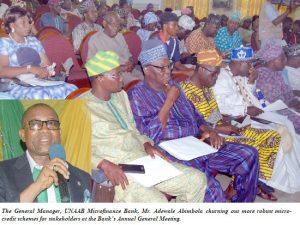

In line with its commitment to render excellent, prompt, efficient and accountable service to its shareholders and customers at large, the UNAAB Micro Finance Bank has held its 2nd Annual General Meeting, with the introduction of the Vice-Chancellor, Professor Kolawole Salako as the Chairman of the Board of Directors and the Bursar, Mr. Chukwunwike Ezekpeazu as one of the Board’s Directors.

The Bank also declared the sum of N469,425,146 as its Balance Sheet size with the total Gross earnings of N101,389,163 and the sum of N18,671,022 as its total profit before tax.

Delivering the Chairman’s Acceptance Speech and Statement, Professor Salako thanked and welcomed the Directors, Shareholders and members of the University Community to the 2nd Annual General Meeting of the UNAAB Microfinance Bank, where he declared that he had accepted the Chairmanship of the Board on assuming office as the Vice-Chancellor in November 2017.

The Vice-Chancellor gave kudos to the past Chairman of the Bank’s Board for his commitment to the development of the Bank, promising that UMFB will continue to churn out more robust microcredit schemes, intended to touch customers and stakeholders with affordable finances that would empower their day-to-day business needs.

Professor Salako hinted that the Bank’s shares are currently being sold to members of the University Community, even as he thanked the University Management and other stakeholders for their support and confidence in the Bank.

In his speech, the Commissioner for Commerce and Industry, Ogun State, Otunba Bimbola Ashiru, represented by the Special Assistant to the Governor on Commerce and Industry, Ms. Sola Arobieke commended the efforts of UMFB on its array of Banking products being offered, such as Automated Teller Machine (ATM) system, Internet Banking Windows, special Agro-Business Loan Scheme (Farmers Delight) and others which she said are not common to most Microfinance Banks across the country.

She lauded the efforts of Microfinance Banks in the development of the nation’s economy saying that their core financial service rendered across the country is to provide quick loan to entrepreneurs in Micro, Small and Medium enterprises sector of the economy.

She also itemized the achievements of the Ogun State Government in the areas of developing micro, small and medium enterprises in the State alongside other agro-allied businesses.

Responding to salient questions asked by shareholders, the Bank’s General Manager, Mr. Adewale Abimbola re-emphasized that the Bank has gone digital, with ATM cards that can be used across any bank in the Country. He also said that the Bank has it Mobile Application downloadable on google play, while promising all stakeholders of improved and unparallel services like never before.